If you are in Indiana and are selling or buying a new home or piece of property to build on, at some point you will need to know if you are in a flood zone. If you are in a flood zone, you might want to or, could be required to get flood insurance. Your flood insurance rate hinges upon how at risk your home is to flooding.

The following steps will allow you to discover if you are in a flood zone using the Indiana Department of Natural Resources Water Department’s Flood Information Portal. Further information and county flood maps are usually available on each county’s online GIS. FEMA’s flood map also provides the same data; however, we choose to use the DNR’s map in this article because it is relatively easy to use and understand.

- Go to the DNR’s Indiana Floodplain Information Portal https://dnrmaps.dnr.in.gov/appsphp/fdms/

- In the top left hand corner of the screen, type the address of the property. You must enter the address in the way it asks you to (300 Michigan Avenue, Auburn, IN, 46706) or your search will be unsuccessful.

- Click Go to Address

- You now will see an aerial image of the property you are searching for with a little yellow house on top and a red line connecting it to the flooding source.

- If the property is in a high risk flood zone it will be covered by a light blue layer that intentionally looks like water.

- Look to the right where it says “Point of interest.”

- On the second line you will see “Effective Flood Zone.” Under that heading you can see what type of flood zone you are in.

Even if the map doesn’t illustrate that your property is covered by a blue flood layer, the “Effective Flood Zone,” will still list a one letter zone, which is confusing. Why does it say you are in a flood zone if you appear to be in the clear?

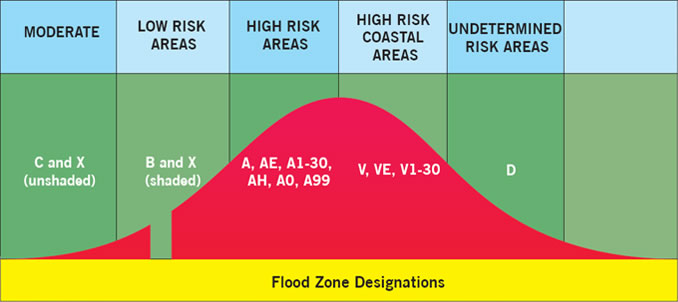

Long story short, FEMA brands each property with a zone, even if there is a .0001% chance that it will flood over the course of 500 years. There are 11 classifications of flood zones. Each is zone is labeled by one or two letters. We will not dive into the 11 type of flood zones because you probably will not understand them unless you are well studied in topography or hydrology.

What you most likely need to know is that if you are in a zone that starts with an A (i.e. A, AE). The A zones are considered “high risk areas,” where flood insurance is required or strongly recommended. If the property is in Zone X it has a low to a moderate risk of flood damage once every 100-500 years. Zone D simply means that the area has not been studied and insurance rates will fluctuate due to uncertainty and lack of data.

This new knowledge can help you weigh the pros and cons of different pieces of properties given their tendency to flood. However, if your goal is to find how much your flood insurance rates will be, we recommend you contact an insurance agent or FEMA. In some circumstances, a building can be removed from a flood zone because it was built above the base flood elevation. Thus, the owner would be able to get lower flood insurance rates. If you are interested in this, you can read our article “How to Get Your Flood Insurance Waived”.

Image by: Visionet Systems